권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

결과 내 검색

동의어 포함

표제지

목차

제1장 서론 8

제1절 연구의 배경 및 목적 8

제2절 연구의 방법 및 구성 11

제2장 이론적 고찰 14

제1절 기업소유구조 이론 14

1. 기업지배구조 메카니즘 14

2. 기업소유구조와 기업가치 16

3. 기업소유구조 상호효과와 기업가치 24

제2절 선행연구 27

1. 대주주와 관련된 선행연구 27

2. 외부대투자자와 관련된 선행연구 34

3. 기업소유구조 상호작용와 관련된 선행연구 42

제3장 연구 방법론 44

제1절 가설의 설정 44

1. 기업소유구조와 기업가치 관련 가설 44

2. 쌍방 인과관계를 통제한 소유구조와 기업가치 관련 가설 47

3. 기업소유구조 상호효과와 기업가치 관련 가설 48

제2절 표본의 선정 및 변수의 정의 51

1. 표본의 선정 51

2. 변수의 정의 53

제3절 패널모형의 설계 58

1. 패널분석의 의의 58

2. 패널분석 모형의 유형 59

3. 검증모형의 설계 62

제4장 실증분석 66

제1절 표본의 기술 통계량 66

제2절 모형적합성 검증 73

1. 기업소유구조와 기업가치 모형의 적합성 검증 73

2. 쌍방 인과관계를 통제한 소유구조와 기업가치 모형의 적합성 검증 81

3. 기업소유구조 상호효과와 기업가치 모형의 적합성 검증 89

제3절 최적모형을 이용한 분석 결과 97

1. 기업소유구조와 기업가치 관련 분석결과 97

2. 쌍방 인과관계를 통제한 소유구조와 기업가치 관련 분석결과 101

3. 기업소유구조 상호효과와 기업가치 관련 분석결과 107

4. 분석결과 요약 111

제5장 요약 및 결론 114

제1절 연구결과의 요약 114

제2절 연구의 시사점 및 한계점 116

참고문헌 118

Abstract 127

[그림 1-1] 연구의 흐름도 13

[그림 2-1] 기업지배구조 메커니즘 16

This study analyzed corroboratively to the enlisted companies in the korea stock exchange based on the related theories of business ownership structure and business value and the preceding researches in domestic and overseas.

The sample companies are the enlisted companies by the end of December 2013 except for the financing companies, analysis period is for 10 years from 2004 to 2013(mutual cause & effect control parameter : 2003~2013). The analyzed data consists of total 4,610 pieces, which sets for the transverse section and each year based on the time series is laid for the balanced panel data. the sample for the analyzed subject.

The samples for analysis to verify the hypothesis related with the business ownership structure and the business value are separated chaebol sample and non-chaebol sample except for the entire sample. and to verify the hypothesis of the inter effect between business ownership structure and business value, in accordance with the share holding rate, separated High sample which is high share holder and Low sample which is low share holder.

Also, to improve the explanation of research, the accumulated research data in a company for a long time was used, when make model, I didn't consider Pooled OLS model which is used general existing researches and I made a model which focus on the analysis of panel data considering the transverse section effect and time series effect without damaging the original data. and also tested the appropriateness of model through Breusch-Pagen Lagrange Multiplier(LM) Test and Hausman Test and then improved the reliability and validity by using the Fixed Effect Model and the Random Effect Model.

The main analysis results of this thesis are as follows.

Firstly, the corroborative analysis result of relation between business ownership structure and business value, found the evidence which showed negative(-) relation between major shareholder rate and business value, which supports the profit damage hypothesis, and observed positive(+) relation between the share holding rate of institution and business value, which supports the strategic alliance hypothesis, and finally found the positive(+) relation between the foreign investor share holding rate and business value, so got the evidence supporting the effective supervisory hypothesis.

Secondly, the analysis to check the non-linear relation existing between business ownership structure and business value, in the entire sample of major shareholding rate and non-chaebol sample showing the meaningful U shape non-linear relation, but the transition point of negative(-) and positive(+) was respectively 82.5%, 98%, if considering the average major shareholder rate is 41%, therefore judged non-linear relation is meaningless.

Thirdly, the analyzing result of the mutual causal relationship between the business ownership structure and business value, there is no mutual causal relationship between the shareholding rate of institution investor and business value without the linear/non-linear types, but there exists mutual causal relationship between the shareholding rate of the foreign investor and the business value. In the analysis of the relationship between the shareholding rate of foreign investor and business value, the consequence implies that the methodology of controlling the mutual causal relationship is desirable.

Fourthly, the consequence of analyzing that business ownership structure affects to the business value in accordance with where the chaebol belongs to, major shareholder rate and institution shareholder rate are always negative(-) effect regardless of where the chaebol belongs to, but the shareholder rate of the foreign investor is influenced in accordance with the chaebol position. when analyzing the relationship between the shareholder rate of the foreign investor and business value, this consequence implies that chaebol included or not should be considered.

Finally, analysis results to check how the institution investor & foreign investor shareholder rate affects to the business value in accordance with major shareholding rate, in case of assuming the linear relation between business ownership structure and business value, major shareholding rate has an influence on the business ownership structure and business value, but if assuming non-linear relation, which has no effect.*표시는 필수 입력사항입니다.

| 전화번호 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

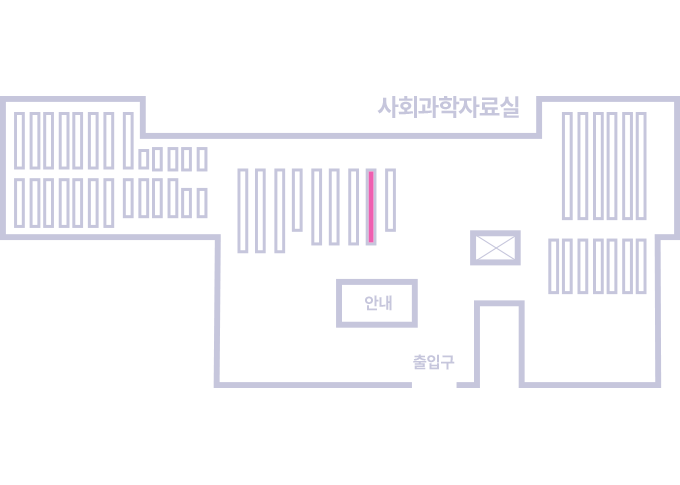

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.