권호기사보기

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 대표형(전거형, Authority) | 생물정보 | 이형(異形, Variant) | 소속 | 직위 | 직업 | 활동분야 | 주기 | 서지 | |

|---|---|---|---|---|---|---|---|---|---|

| 연구/단체명을 입력해주세요. | |||||||||

|

|

|

|

|

|

* 주제를 선택하시면 검색 상세로 이동합니다.

title page

Abstract

Contents

Chapter 1. Introduction 15

Chapter 2. Estimating and testing optin pricing models in an economy with transaction costs 19

1. Introduction 20

2. Implied volatility and option pricing model 22

2.1. Black-scholes model and implied volatility 22

2.2. Alternative models 24

3. Estimating option pricing parameters in a black-scholes economy with transaction costs 26

3.1. Data generation by simulation 27

3.2. Volatility smile 28

3.3. Parameter estimation of option pricing models 29

4. Estimating option pricing parameters in a stochastic volatility or jump economy with transaction costs 31

5. Hedging performance 33

5.1. Single-instrument hedges 33

5.2. Delta-neutral hedges 35

6. Conclusion 36

Chapter 3. The Impact of net buying pressure on implied volatility : The learning hypothesis versus the limit of arbitrage hypothesis 55

1. Introduction 56

2. Net Buying pressure hypotheses 58

3. Data 62

3.1. Data specification 62

3.2. Classification of options 63

3.3. Net buying pressure and investor types 64

4. Empirical analysis 67

4.1. Daily regressions 68

4.1.1. Empirical methodology for daily regressions 68

4.1.2. Daily regression results 71

4.2. Intraday regressions 74

5. Conclusion 80

Chapter 4. The dynamics of trades and quote revisions across stock, futures, and option markets 92

1. Introduction 93

2. What influences trade and quote revisions? 96

2.1. Information effect 97

2.2. Liquidity effect 98

2.3. Hypothetical market dynamics 99

3. Data 102

3.1. KOSPI 200 index and its derivatives 102

3.2. Summary statistics 104

4. Empirical analysis 105

4.1. Information content of return and order imbalances 105

4.2. Lead-lag relations among order imbalances and returns across markets 107

4.3. The Dynamics of returns and order imbalances across markets 109

4.4. Investor groups and market dynamics of returns 113

5. Conclusion 115

Chapter 5. Tests of alternative models for the pricing of korean treasury bond futures contracts 125

1. Introduction 126

2. Pricing the KTB futures 129

2.1. The specifications of the KTB futures 129

2.2. The ad-hoc cost-of-carry futures price 130

2.3. The theoretical price for KTB futures contracts 131

2.4. Term structure based futures pricing models 133

3. Parameter estimation 135

3.1. Single factor models 135

3.2. The Hull-White two-factor model 136

4. Empirical results 138

4.1. Data 138

4.2. Comparison between the market price and the model prices of the KTB futures contracts 138

4.3. Determinants of pricing errors 141

5. Exploiting the underpricing phenomenon in the KTB futures market 143

5.1. Investment and hedging strategies 143

5.2. Results 145

6. Conclusion 146

Chapter 6. Concluding remarks 153

요약문 155

References 157

Acknowledgements 164

Curriculum vitae 166

Figure 2.1. Implied volatility curves in black-scholes economy 47

Figure 2.2. Implied volatility curves in alternative economies 49

Figure 3.1. Impacts of the extreme - NBP on ATM options 90

Figure 3.2. Impacts of the extreme - NBP on OTM options 91

This study investigates price anomalies by examining market dynamics and price formation process in derivative markets.

Firstly, we examine the effect of transaction costs on volatility smile phenomenon in option market, one of the famous financial anomalies. In addition, we investigate the effect of transaction costs on parameter estimation, and hedging of options. Using simulations, we document that transaction costs can generate the volatility smile phenomena even in the Black-Scholes economy. Particularly, volatility smile effect is very strong for short-term options and it disappears as the maturity of options becomes longer. Transaction costs cannot reject the true model falsely. All the parameter values that are supposed to be zero are not statistically significant even in the presence of transaction costs. In hedging, the Black-Scholes model performs better than any other model in any case. This may result from the parameter instability of the cross-sectional estimation method.

Secondly, we examine the price effect of information asymmetry and informed investors' preference on option market. To do this, we investigate the information impacts of net buying pressure on implied volatility and the intraday relation between index and option markets, using the intraday data of the KOSPI 200 index option market. We observe that the net buying pressure of call(put) options raises implied volatilities of calls(puts), while the net buying pressure of put(call) options lowers implied volatilities of calls(puts), Moreover, we document that the net buying pressure in the option market leads the stock market return. These results suggest that option traders in the KOSPI 200 index option market are directional traders informed by future index price movement rather than volatility traders informed by future index volatility, and also support the learning hypothesis rather than the limit of arbitrage hypothesis of Bollen and Whaley(2004) on the U.S. option markets.

Thirdly, we investigate the dynamics of returns and order imbalances across the KOSPI 200 cash, futures and option markets, to examine the effect of information and liquidity on market. Although we find some evidence suggesting the liquidity effect in return dynamics, the information effect is more dominant than the liquidity effect in these markets. In addition, we document that returns and order imbalances transmit information across markets. We observe that information seems to be transmitted more strongly from derivative markets to their underlying asset market than from the underlying asset market to their derivative markets.

Finally, we document that domestic institutional investors prefer stocks and futures, domestic individual investors prefer options, and foreign investors prefer stocks relative to other investor groups when they have new information. All investor groups seem to contribute to information transmission. Finally, we examine the underpricing phenomenon of the KTB futures. We examine whether this underpricing phenomenon is caused by using the wrong model to price the futures contracts. We document that the difference between the model price and the market price of KTB futures decreases substantially if the correct term-structure-based model is used to estimate the model price of KTB futures. In addition, even though the underpricing phenomenon can be exploited to generate some trading profits, the profits cannot be regarded as arbitrage profits. Thus, we believe that the underpricing phenomenon is illusory, and that much of it can be attributed to the wrong model being used in industry.*표시는 필수 입력사항입니다.

| 전화번호 |

|---|

| 기사명 | 저자명 | 페이지 | 원문 | 기사목차 |

|---|

| 번호 | 발행일자 | 권호명 | 제본정보 | 자료실 | 원문 | 신청 페이지 |

|---|

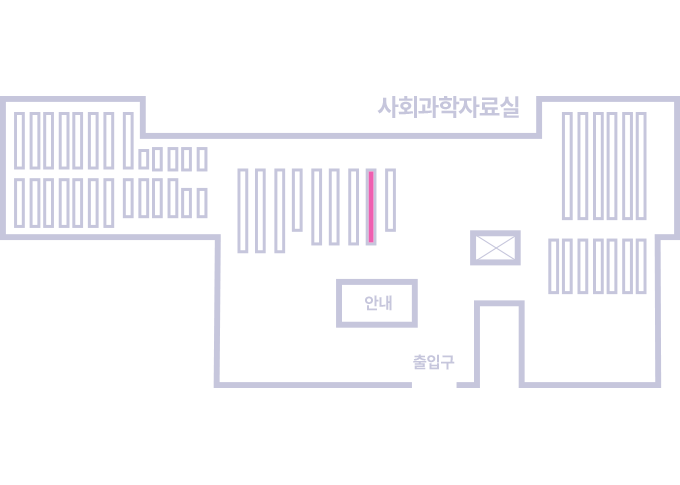

도서위치안내: / 서가번호:

우편복사 목록담기를 완료하였습니다.

*표시는 필수 입력사항입니다.

저장 되었습니다.